Posted by Ulrich Kirchmann and Sagé de Clerck[1]

The German state of Hesse has published a one-off set of illustrative financial statements for the fiscal year 2019 that comply with International Public Sector Accounting Standards (IPSASs). The objective was to test the applicability of IPSAS compared to the accrual-based accounting standards currently applied by the state. This experiment enriches the dialog on whether IPSAS is an appropriate basis for developing European Public Accounting Standards (EPSAS), as well as the long-standing debate on cash versus accrual accounting in Germany.

IPSASs are accounting standards issued for use by public sector entities around the world in the preparation of financial statements. The standards are often used as a reference for countries developing their own national accounting standards and policies under the cash or accrual accounting basis. In Europe, the European Public Sector Accounting Standards (EPSAS) project aims to develop harmonized accrual accounting standards for the member states of the EU. Since 2011 several studies under the EPSAS project have screened the conceptual suitability of existing IPSAS standards as a reference for EPSAS. The compilation of the illustrative financial statements of Hesse is the first practical test of IPSAS against national accrual standards in Germany.

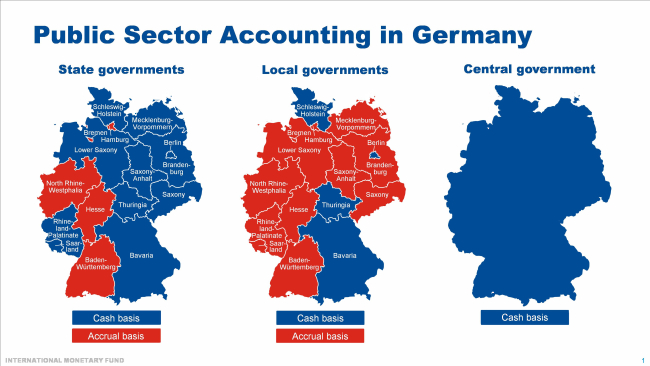

In Germany cash-based accounting concepts are still widely used at federal and state level. In the last two decades, several municipalities and some states have successfully implemented accrual accounting but the picture is still very mixed compared to other countries (see charts below).[2] Hesse took the decision to move to accrual in 1998 and started to publish its accrual-based statements for 2009. These financial statements are based on German private sector accounting standards (German Commercial Code: Handelsgesetzbuch) and hence diverge from IPSASs. The experimental application of IPSASs in Hesse thus provides insights on how financial statements that are prepared according to IPSASs differ from the usual approach. IPSASs could also serve as a reference framework for harmonizing public sector accounting in Germany.

Developing EPSAS based on IPSAS is a concept that has been exposed to criticism – especially in Germany.[3] It has been criticized for not sufficiently reflecting the principle of prudence and public sector specific considerations related to budgeting and public financial management. It is also argued the IPSAS standards contain too many accounting policy options, and do not sufficiently recognize the importance of producing public goods using assets that either cannot be sold or can be sold only for an amount significantly below their acquisition cost.

The 2019 IPSAS-based Financial Statements of Hesse note how the application of IPSASs reduces the equity of the state. 90 percent of the impact (EUR -61 bn) is triggered by differences in measuring pension and other post-employment obligations. This significant reduction in equity is caused by applying a discount rate of 0.8 percent under IPSAS compared to 3 percent under the current accrual-based standards applied by Hesse.

Especially with respect to the measurement of pensions the criticism of IPSAS for overstating the financial impact is not justified. The current low interest rate environment provides advantages for the public sector due to low refinancing costs. However, IPSAS follows market yields on government bonds for the measurement of pensions which means that these future obligations are also discounted using current interest rates. In the case of Hesse the further decrease of interest rates observed in 2019 triggered significant actuarial losses of EUR 16 bn that were recognized directly in equity during that year. Overall, it can be concluded that IPSASs represent a prudent approach to measuring the financial health of the state of Hesse. By applying IPSAS concepts, the equity of the state amounts to EUR -206 bn as of December 31, 2019. This represents a decrease of EUR 86 bn compared to the equity of EUR -120 bn measured under the accrual standards that are currently applied in Hesse.

The publication by Hesse of IPSAS-based Financial Statements for 2019 has shown that IPSAS could serve the objective of providing a true and fair view. Detailed disclosures provide stakeholders with additional information to analyze the statements.[4] The results of the project shed new lights on the discussions in Germany and other countries on the suitability of IPSASs. The outcome is expected to further stimulate the debate on harmonizing accounting standards in Europe which could contribute to the further development of EPSAS. Further details of this IPSAS pilot project are available on the project website of the Ministry of Finance of Hesse: https://ipsas.hessen.de

[1] Ulrich Kirchmann is a Technical Assistance Officer and Sagé de Clerck a Senior Economist in the IMF’s Fiscal Affairs Department.

[2] The charts are based on Boddenberg, M, IPSAS Financial Statements 2019 of Hesse - Harmonising accounting in Germany and Europe, March 2021, page 4, and follow core government activities. In jurisdictions where the cash basis prevails, some municipalities apply accrual accounting on a voluntary basis.

[3] A comprehensive overview of the pros and cons concerning the suitability of IPSAS for harmonizing public sector accounting in the EU is provided in the Institute of Public Auditors (IDW) in Germany’s Factsheet “IPSAS as a Reference Framework for EPSAS”. It can be downloaded in German and English. The paper describes the path towards common accounting principles and discusses the pros and cons of IPSAS as the basis for EPSAS.

[4] A report on the IPSAS project by the Hessian Ministry of Finance with detailed assessments can be downloaded in German and English.

Note: The posts on the IMF PFM Blog should not be reported as representing the views of the IMF. The views expressed are those of the authors and do not necessarily represent those of the IMF or IMF policy.